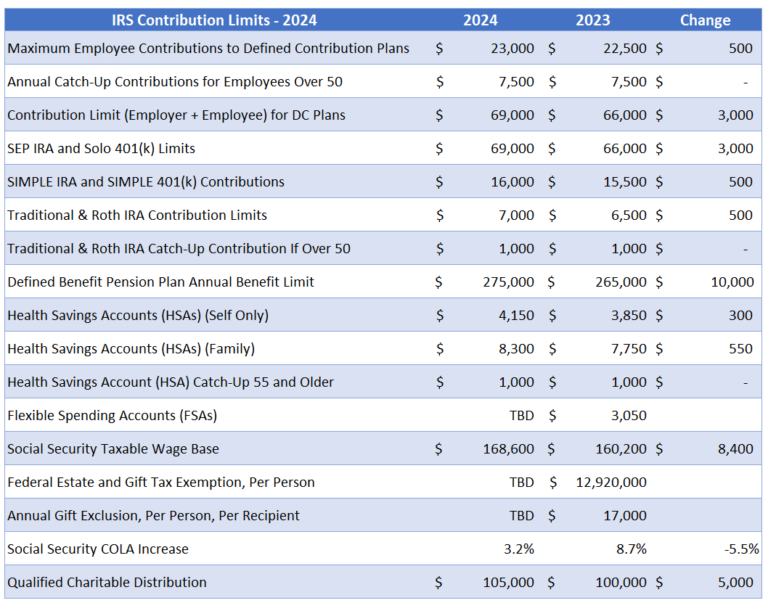

2025 401k Limits. For 2025, the 401 (k) limit for employee salary deferrals is $23,000, which is above the 2025 401 (k) limit of $22,500. The irs does set annual contribution limits for the employee portion, which for 2025, was $23,000 for employees under age 50 and $30,500 for employees 50 or older.

The 401(k) contribution limit is $23,000. For those with a 401 (k), 403 (b), or 457 plan through an employer, your new maximum contribution limit will.

2025 401k Limits Chart Tedda Ealasaid, For 2025, the compensation limit (which is the amount of your income that’s used to figure out 401(k) contributions and matches) is limited to $345,000. For 2025, the 401 (k) limit for employee salary deferrals is $23,000, which is above the 2025 401 (k) limit of $22,500.

401k 2025 Contribution Limit Chart, Here's how the 401(k) plan limits will change in 2025: The basic employee contribution limit for 2025 is $23,000 ($22,500 for 2025).

2025 401k Deferral Limits Casey Raeann, The irs has announced the 2025 contribution limits for retirement savings accounts, including contribution limits for 401(k), 403(b), and 457(b) plans, as well as income limits. In 2025, individuals under age 50 can contribute up to $23,000 to traditional and roth 401(k) plans.

401k 2025 Maximum Angil Brandea, The 401 (k) contribution limit is $23,000 in 2025. For those with a 401 (k), 403 (b), or 457 plan through an employer, your new maximum contribution limit will.

Roth 401k 2025 Limits Davine Merlina, The 401(k) contribution limit is $23,000. The limit for combined contributions made by employers and employees cannot exceed the lesser of 100% of.

Higher IRA and 401(k) Contribution Limits for 2025 PPL CPA, Get the latest 401(k) contribution limits for 2025. In this piece, we’ll review the 401(k) contribution limits for 2025 and 2025.

2025 IRS 401k IRA Contribution Limits Darrow Wealth Management, Bureau of labor statistics (bls) report published june 12, 2025. The total overall 401 (k) contribution limit for 2025, which includes employer matching contributions and nonelective contributions, is $69,000.

401k And Roth Ira Contribution Limits 2025 Over 50 Gwenni Marena, 401 (k) pretax limit increases to $23,000. As of 2025, individual employees have a 401 (k) contribution limit of $22,500, allowing them to contribute this amount annually to their 401 (k) account on a.

2025 401k contribution limits Inflation Protection, In 2025, individuals under age 50 can contribute up to $23,000 to traditional and roth 401(k) plans. The limit for combined contributions made by employers and employees cannot exceed the lesser of 100% of.

Irs 401k Deferral Limits 2025 Eloisa Shaylah, The update forecasts a $1,000 boost to this year’s 401 (k) elective deferral limit of $23,000, which would bring the 2025 limit to $24,000. Workers who contribute to a 401 (k), 403 (b), most 457 plans and the federal government’s thrift savings plan can contribute up.